A lot can happen in nine months

The Chancellor’s Autumn Statement produced few surprises and no giveaways.

In March 2013, George Osborne’s job security looked similar to that of a Premier League manager. Talk was of a triple dip recession, government borrowing was stuck at £120bn and the Office for Budget Responsibility was running out of red ink for its projections.

Nine months later, the Chancellor was able to present his Autumn Statement having avoided the triple dip recession and with economic recovery seemingly on a solid footing. He could even talk of a budget surplus being in sight, albeit not until 2018/19. There the rosy picture stopped: 18 months before a general election is not the time for giveaways. Thus the raft of announcements and re-announcements ended up as tax-neutral. The main points of interest were:

- The personal allowance will increase to £10,000 in 2014/15 and the higher rate (40%) tax threshold will increase by £415 to £41,865

- There will be a new transferable tax allowance of £1,000 for married couples and civil partners from April 2015.

- From 6 April 2015 employers will no longer pay Class 1 National Insurance Contributions on earnings paid up to the Upper Earnings Limit to any employee under the age of 21.

- The final exemption period for private residence relief will be halved to 18 months from April 2014 while from April 2015 capital gains tax will apply to future gains on residential property owned by non-resident individuals.

- The overall annual Individual Savings Account (ISA) subscription limit for 2014/15 will rise to £11,880, of which £5,940 can be invested in cash.

- A raft of specific employment anti-avoidance measures were announced, mostly aimed at arrangements designed to disguise employment.

- New ‘simplified’ IHT rules for trusts will be introduced from April 2015, following further consultation.

Seed Enterprise investment schemes

The Treasury has released figures on the take up of seed enterprise investment schemes.

The Seed Enterprise Investment Scheme (SEIS) was originally outlined in the 2011 Spring Budget, but did not formally start life until April 2012, after the usual smattering of re-announcements. It was designed to encourage investment in new, small start-up companies with no more than 25 employees.

In November the Treasury released a ‘news story’ (aka press release) explaining how the scheme was working. It revealed that over 1,100 companies had raised money through the SEIS, with the average amount invested of £72,000 – less than half the maximum permitted of £150,000. That meant total capital raised was about £82m, compared with £525m provided by the main Enterprise Investment Scheme (EIS) in 2010/11, the most recent year for which HMRC have published data.

At the same time as the Treasury was highlighting its numbers, HMRC issued some research they had commissioned into the early months of the scheme. Predictably this reported that “The main aims of investors for participating in SEIS were to take advantage of the front end tax relief… and the Capital Gains Tax (CGT) exemptions from the likely gains.” More surprising was the fact that those putting money into SEIS “were generally individuals who made relatively few investments (rather than business angels).”

This does sound eerily like the tax tail wagging the investment dog. By their nature SEIS companies are very high risk – as the HMRC report shows, many enterprises resort to SEIS because funds are unavailable from traditional sources. If you are tempted by the tax reliefs SEIS offer, do take advice before committing any money. There is a role for small companies in well-diversified portfolio, but SEIS companies are at the nano-sized end of small and may not be the right route to choose.

The value of tax reliefs depends on your individual circumstances. Tax laws can change. The Financial Conduct Authority does not regulate tax advice.

B, C and now a

The DWP is proposing a new type of pension scheme.

At present, pension schemes can be broadly divided into two types:

Defined Benefit (DB) Schemes which typically offer a retirement income, or a specific level of pension savings, based on a formula related to an employee’s salary and/or the length of service in the scheme. The classic example is the occupational scheme that offers 1/60th final pensionable salary for each year of service.

Defined Contribution (DC) Schemes which are more akin to savings plans. A DC schemes builds up a fund from invested contributions that are converted to a pension at retirement. Personal pensions and the government’s default auto-enrolment scheme, NEST, are both DC arrangements.

DB schemes place inflation and investment risks solely with the employer and, as a consequence, have been disappearing from the private sector for some years – the latest report from the Pensions Regulator says less than one in seven private sector DB schemes still accept new members. In DC schemes, the risks are all left to the individual member, which can have unwelcome consequences if poor investment conditions coincide with their retirement date.

The government, and in particular Steve Webb the Pensions Minister, have been struggling to find some form of compromise between DB and DC. The result, now put out for consultation by the DWP is DA – defined ambition. To quote the paper, “A DA scheme would be a scheme under which members are given some form of guarantee in respect of their pension, but not complete certainty of the level of income that they will receive from it in retirement, or when it would be paid.” For example, it is suggested that an occupational scheme could offer a guaranteed level pension, but leave any inflation-proofing as a discretionary benefit, to be reviewed each year. Similarly a scheme could promise a particular rate of pension accrual, but reserve the right to change the retirement age to reflect rising longevity.

The paper has only a brief consultation period of six weeks, with draft legislation promised in the New Year. How much interest employers and pension providers will take in developing DA remains to be seen, particularly with all the other developments going on in the pension area. For now, the prospect of DA will probably do little to stop the move to away from DB to DC.

At least we beat mexico

The UK state pension system has come under the spotlight again.

The Organisation for Economic Cooperation and Development (OECD) has just published its 2013 snapshot of pension provision amongst its members. As usual, it does not paint a great picture for the UK:

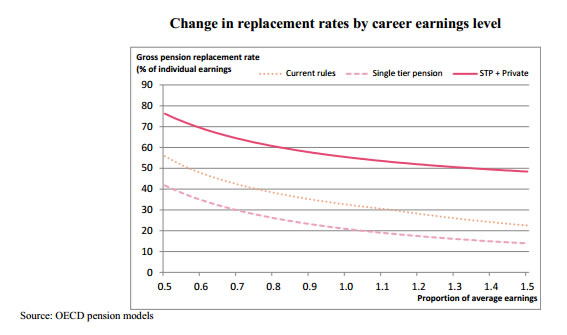

- Based on the existing UK state pension structure (basic state pension and state second pension), someone on full time average earnings (£35,900 according to the OECD) with a complete working life can expect the state pensions to equal 32.6% of their earnings on retirement. In the OECD league table that puts the UK one from bottom, with only Mexico (28.5%) scoring less. The OECD average is 55.4%.

- Higher earners (150% of average earnings in OECD-speak) can expect 22.5% replacement retirement income compared to the OECD average of 48.4%.

- When the OECD looks at the new single tier pension due in 2016, its conclusion is that the replacement rate would fall to just 21%. The drop is a reminder that the new regime will mean the loss of the earnings–related element provided by state second pension.

- The situation is somewhat redeemed when the OECD adds into their calculations an 8% contribution assumption under pension auto-enrolment, even though this is not compulsory. The pension that auto-enrolment produces, when combined with the single tier pension, brings long term UK benefits in line with the OECD average at all earnings levels, as the graph below shows. Nevertheless, the high earner still faces a replacement rate of slightly under half, with a pension age of at least 67 from 2028.

The main upside from joining Mexico in the relegation zone is UK state retirement provision is relatively cheap. The OECD says it currently costs 6.2% of GDP against an average of 7.8% and, for example, 13.7% in France.

HMRC tightens pension scheme registration rules

In the fight against pension liberation fraud, HM Revenue and Customs (HMRC) has tightened its pension scheme registration rules with effect from 21 October 2013.

The government is continuing to work with various bodies to crack down on pension liberation fraud and is investigating new reports of this abuse. On 23 October, Pensions Minister Steve Webb stated that the Pensions Regulator (TPR) is currently looking into 27 live cases of pension liberation fraud involving around £185 million.

Pension liberation schemes offer pension members early access to their pension fund (which is normally accessible at the age of 55), but they often fail to warn the member that participating in such a scheme will leave them with a large tax bill and the possibility of losing most of their pension fund.

Pension scheme registration with HMRC, which carries important benefits in terms of tax relief on contributions and investments, will no longer be automatically confirmed, thanks to a move away from a ‘process now, check later’ approach.

As of 21 October, once the online form is successfully submitted, the scheme will no longer be automatically registered, and any contributions received won’t qualify for tax relief, while any transfers received from another registered pension scheme will be an unauthorised payment. The application is then reviewed by HMRC and additional information may be required before HMRC can make a decision on whether or not the scheme can be registered. The purpose of this regulation is to give HMRC the chance to identify any potential new liberation schemes. The tightening up of the registration rules by HMRC is part of the government’s strategy in preventing further fraudulent activity.