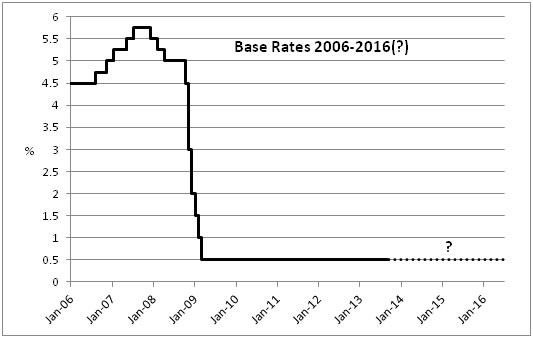

Base Rate at 0.5% until 2016…

August was not a quiet month at the Bank of England.

The new Governor of the Bank of England, Mark Carney, came to the job with a ‘rock star’ central banker reputation which his predecessor, Sir Mervyn King, lacked. Mr Carney was expected to reform the Bank’s policies and in August he took a major step in this direction.

What he did was make an announcement which fits the economic euphemism of the moment, ‘forward guidance’. At its simplest, forward guidance means telling the market the central bank’s views of (and plans for) future short term interest rates. However, in the UK context it was not that simple. Mr Carney told us that the Bank “intends not to raise Bank Rate from its current level of 0.5% at least until … the unemployment rate has fallen to a threshold of 7%”, which the Bank’s economists predict will be in mid- 2016. The current (April-June) unemployment figure is 7.8%.

It was not – despite the various “another three years” headlines – a blanket promise. The Bank detailed three “knockouts” (its words) that would prompt earlier action:

1. The Bank considers it more likely than not, that CPI inflation 18-24 months ahead will be 2.5% or more;

2. Medium-term inflation expectations no longer remain “sufficiently well anchored”; and

3. A significant threat to financial stability related to the continued low rates.

The Bank (and the Chancellor’s) hope is that the guidance encourages companies and consumers to borrow, safe in the knowledge they will not be hit by a sudden rise in rates. Mr Carney used a similar approach in his last job, at the Bank of Canada, when he said in April 2009 rates would stay flat for at least a year.

The Liberal Democrats have put forward their latest ideas on tax

The next General Election is due on 7 May 2015 and politicians are already jostling for position, with talk of another coalition in the air. As a result, the Liberal Democrats’ latest paper on tax policy has considerably more relevance than some of its predecessors. The paper, issued for discussion at this month’s party conference in Glasgow, makes a wide range of proposals. Among the more notable are:

- An end-of-the-Parliament target for the personal allowance to match the income level equivalent to full-time employment on the National Minimum Wage (around £12,300 from October 2013). The allowance is currently £9,440, rising to £10,000 in 2014/15.

- A choice of either leaving the top rate of income tax unchanged, or returning it to 50%, subject to a study showing “that it was likely (on the balance of probabilities) that the revenue raised was less than the cost of making the change.”

- A further reduction in the lifetime allowance for pensions to £1m, but no other changes to pension tax reliefs. The allowance is currently £1.5m, falling to £1.25m from 6 April 2014 (at the same time as the annual allowance drops by a fifth to £40,000).

- A reduction in the individual capital gains tax annual exemption from the current £10,900 to £2,000, with gains taxed at full income tax rates, i.e. up to 45%/50%. To complicate matters for the greatly increased number of CGT payers, indexation relief would be reintroduced.

- The introduction of a Land Value Tax, to “replace business rates and property taxes.” However, it would not usurp the role of the Lib Dem’s beloved mansion tax, which remains on the agenda at 1% of residential property value of £2m.

- The period after which lifetime gifts would be ignored for inheritance tax purposes would be extended from seven years to fifteen. Ultimately the tax would move to an accessions/capital receipts basis, under which tax would be paid by the recipient(s) of bequests (after a lifetime allowance is exceeded), based on their income and circumstances.

While these ideas may never see the light of parliamentary day, they could serve as a useful checklist for long term tax planning.

The Association of British Insurers has started to publish annuity tables, with some interesting results

Annuity rate league tables now regularly appear in newspapers and on websites. They can be a starting point if you are thinking of converting your pension pot into a retirement income. However, the tables are generally of limited use. For example, many life companies that are not actively seeking annuity business do not supply rates and the tables themselves cannot cover all the options available.

The Association of British Insurers (ABI) has now attempted to address these issues with its own annuity tables, drawn from 27 member companies’ data. The tables are not real time and show rates for 12 fictional customer profiles, all based on age 65. As the ABI says (in bold) “The rate which will apply to your personal circumstances will be different.” Nevertheless, the tables do serve one purpose: they underline the importance of shopping around for the best annuity rate.

Take, for instance, the ABI’s first example of a Manchester resident aged 65 with no health problems, wanting to spend £18,000 on an annuity with no dependant’s benefits. The best rate is £1,099.92 a year, while the worst (from a major bank-owned insurer) is £839.52 – nearly a quarter less. Assume the Mancunian’s health is very poor and the range widens to between £1,778.23 and £1,213.59.

What you think happens, might eventually happen

The government is consulting on reforms to intestacy

What happens if you die leaving only your spouse/civil partner, no children and no will?

You might imagine that everything goes to the survivor, but currently that is not always the case. Under the intestacy rules for England and Wales, a surviving spouse/civil partner would receive:

- Personal chattels;

- £450,000 outright; and

- One of half the residue outright.

The other half of the residue would go to your parent(s), failing whom your siblings or, if they have predeceased you, their offspring. The rules in Northern Ireland are very similar, while Scotland has its own distinctly Scottish regime.

The Ministry of Justice is now proposing to reform English and Welsh intestacy rules, so that where there are no children, the surviving spouse will inherit the whole estate. There are also revisions planned for the estate distribution when there are children involved.

The ministry says that its proposed changes will “ensure the laws on intestacy become closer aligned with public expectations”. However, any reform will not alter the fact that an up to date will that’s spells out what you want is a better course of action than relying on the state’s interpretation via the intestacy rules.

Your will is up to date, isn’t it..?

ISA: Spread evenly over six months

In volatile market conditions, drip feeding your investment could be a sensible idea.

Have you made your full 2013/14 ISA investment yet?

The volatile market conditions of recent times may have caused you to worry about getting the timing right for stocks and shares ISA investment. It is unpalatable to make a lump sum investment which then loses value the following week.

The trouble is that in reality it is virtually impossible to win at the short term timing game except with a degree of luck: the professionals at investment institutions generally do not try. For them, the short term gyrations are just market ‘noise’: what matters is the long term. It is impossible to land on exactly the right time to buy an investment.

Drip feeding your ISA offers a compromise between biting the bullet with a one-off investment and waiting for the ‘right time’, something that only becomes obvious with hindsight. For example, you could opt to invest £1,920 each month from October 2013 through to March 2014. That would mean you would have invested your stocks and shares ISA maximum for this tax year of £11,520 and, unless you were extremely unlucky, you would not have invested all of it at the top of the market. But by the same token, you would be just as unlikely to have invested all your money at the market bottom.

By investing the same amount each month, you buy more shares or units in your chosen fund when their prices are low and fewer of them when prices are high. The mathematics behind this – pound cost averaging – mean that your average investment price will be less than the average across the dates you invest. However, if the market rises steadily from October to March, then the one-off investment would have been a better choice. But that requires hindsight…