Interest rates: down, sideways or up?

There were conflicting news reports on interest rates in August.

The conflicting signals about interest rates and, in particular, the actions of Santander, are a reminder that in the post-financial crisis world the Bank of England’s (BOE’s) base rate is no longer the influential benchmark that it once was.

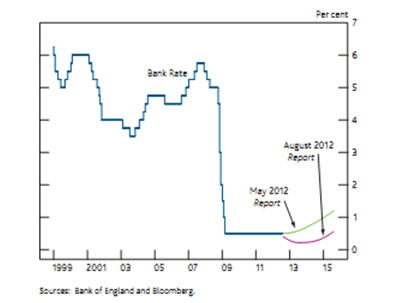

For example, this graph is taken from the latest Quarterly Inflation Report (QIR) from the BOE, issued early last month. It shows the historic pattern of base rates and the projections for future rates in the May and August QIRs. The mauve August line dips downward, suggesting that the base rate could be cut to below its current 0.5% and remain there well into 2015. This reflects a view in the money markets at the start of August that the BOE would lower base rate further as one of its measures to stimulate the flagging UK economy.

Although the graph appeared in an official document, the idea that base rate would move even nearer to 0% was not endorsed by Mervyn King, the BOE’s Governor. When asked about the possibility of cutting interest rates at the QIR press conference, Sir Mervyn said ‘…it would damage some financial institutions and it would therefore in all probability have an element at least of it being counterproductive, which is precisely why we haven’t cut

Bank Rate. …Another quarter point on Bank Rate is not going to be the difference between having a recovery, or not having a recovery ’.

While the money market was predicting a fall and the Governor was suggesting no change, one of the major mortgage lenders, Santander, decided that their lending rates would rise. From 3 October its standard variable rate (SVR) will increase by 0.5% to 4.74%. Other lenders have raised their SVRs this year, including Halifax, which pushed its SVR from 3.5% to 3.99% in May. Santander blamed the higher costs of raising funds and increased administration expenditure, as did the other lenders. However, the press was generally critical, viewing Santander’s move as ‘profiteering’.

Your home is at risk if you do not keep up with repayments on a mortgage or other loan secured on your property.

National Savings & Investments introduces penalties

The days of penalty-free savings certificates are coming to an end.

National Savings & Investments (NS&I) finds itself in a strange position these days. Its remit from the Treasury for 2012/13 is simply to hang on to the cash it has – in other words, NS&I must balance any outflows with inflows, but overall raise no fresh capital. This might seem an odd directive coming from a Government that’s so deeply in the red, but the hard truth is that it is both cheaper and more efficient for Mr Osborne to raise the £166 billion he needs in this financial year by selling gilts to institutional investors. In late August, for example, the Treasury was able to sell almost £5 billion worth of a six-year gilt at an effective interest rate of under 0.8%.

One consequence, from NS&I’s perspective, is that National Savings Certificates (NSCs), Guaranteed Income Bonds and Guaranteed Growth Bonds will remain unavailable to new investors until at least next April. These fixed-rate investments are too popular, given NS&I’s funding objective. Nevertheless, in mid-August NS&I announced changes to the terms of all its fixed-rate products (including Children’s Bonus Bonds). These take effect for new investments (including re-investments of maturing certificates) from 20 September.

The most significant revisions were to NSCs, both fixed-rate and index-linked:

- There will be a 90-day interest penalty on encashment before maturity, whereas previously there had been none.

- For index-linked certificates, there will also be no index-linking for the year when the whole or part of a certificate is encashed.

- Interest (or, for index-linked certificates, the bonus) will be applied on a flat rate throughout the term, rather than the year-by-year escalating basis currently used.

- The minimum age for direct investment will rise from 7 to 16, although certificates can still be held under trust for minors.

- At maturity, a switch from one type of certificate to another will count towards your (£15,000) investment allowance for any new issue on sale.

These changes reduce the appeal of NSCs, particularly index-linked certificates. One point to watch if you have existing certificates is that, at maturity, they automatically reinvest on the new terms unless you choose to withdraw your money.

Bye-bye bamboo bonanza

The Financial Services Authority (FSA) wants to ban sales of exotic funds.

If you ever look at websites targeting stock market investors, you have probably noticed advertisements offering double-digit returns from various unusual investments. Typical examples include bamboo, fine wines, traded US life assurance policies and carbon credits.

Most of these ‘investments’ fall into the category of Unregulated Collectives Investment Schemes (UCIS), which the law says may be marketed only to specific categories of investor and not to the general public. However, the FSA has found that the restrictions on promotion are ‘widely misinterpreted, poorly understood and sometimes simply ignored’. The FSA estimates that over the last five years investors have lost around £200 million in total from such schemes.

The overall amount invested in UCIS and similar investment schemes is now about £4 billion according to the regulator, a good indication of how widespread the mis-promotion has been. The FSA now wants to tighten the marketing and advice rules for UCIS and extend the new restrictions to similar investment structures. In effect, UCIS and the like will become unavailable to most ‘ordinary’ individuals.

The FSA’s move is generally to be welcomed. Too many UCIS fell into the ‘if-it-looks-too-good-to-be-true-it-probably-is’ category.

Pensions and quantitative easing

The Bank of England (BOE) has been defending the impact of its actions on pensions.

For the last three and a half years, the BOE has pursued a policy of ultra-low short-term interest rates and quantitative easing (QE). QE, which has often (incorrectly) been described as printing money, has so far seen the BOE buy £325 billion worth of UK government bonds. That figure represents over a third of the non-index-linked gilts market and is continuing to rise as the programme of QE continues.

The BOE’s gilt-buying spree has pushed down the returns available on gilts dramatically. At the start of March 2009, just before QE began, 15-year gilts yielded 4.13%, whereas they now yield about 2.1%. That fall has had two major impacts on pensions:

- Annuity rates have dropped sharply, in line with the fall in long-term yields. A consequence of this effect has been a drop in income drawdown limits, which are also driven by long-term yields.

- Final salary pension schemes have seen a surge in the size of their liabilities, which are valued on the basis of long-term yields – the lower the yield, the higher the value. Generally speaking, assets on the other side of the pension scheme balance sheet have not kept pace. The result has been widening pension scheme deficits.

On both counts, various pension bodies have criticised the BOE. The House of Commons Treasury Select Committee recently waded in, asking the BOE to explain its views on the groups – like pension funds – that were negatively affected by QE. The BOE has now responded, and its main argument is that QE ‘pushed up the price of equities by at least as much as they have pushed up the price of gilts’.

It is an interesting swings-and-roundabouts defence, but whether the BOE can lay claim to all of the recovery in share prices since March 2009 is a moot point.

Company car fuel rates

Advisory rates are falling – but only for LPG.

If you have a company car, you probably have to buy your own fuel for business mileage and make an expense claim. ‘Free fuel’ is now something of a rarity – the latest HMRC statistics (for 2010/11) show only about a quarter of company car drivers had fuel paid for by their employer, down from over a third in 2004/05. The proportion in 2012/13 is probably smaller still because of the harsh tax treatment of free fuel (see box below).

When free fuel is not provided, HMRC sets advisory fuel rates for employer payments in respect of business mileage. These are reviewed quarterly and were kept unchanged from 1 September 2012, except for LPG vehicles, where there was a 1p-2p per mile cut. The mileage rates are now:

Engine Size |

Petrol |

LPG |

Diesel |

1,400cc or less |

15p |

10p |

12p |

1,401cc – 1,600cc |

18p |

12p |

12p |

1,600cc – 2,000cc |

18p |

12p |

15p |

Over 2,000cc |

26p |

17p |

18p |

For ‘free’, read ‘expensive’

Barbara has a BMW 320d company car with CO2 emissions of 120g/km. If her employer gave her ‘free fuel’, the taxable benefit in 2012/13 would be £3,636, i.e. £1,454 extra tax for a higher-rate taxpayer like Barbara.

£1,454 would buy her over 1,000 litres of diesel at current prices – enough to cover about 13,500 miles at the BMW’s average 61.4mpg. Because Barbara’s private mileage is only 8,000 miles a year, she is better off without ‘free fuel’.

She also gains from her business mileage allowance. Barbara receives 15p a mile fuel allowance for business mileage, but her BMW is sufficiently economical that her actual cost of fuel is only about 10.5p a mile.