Not the Budget

The spending round announcements at the end of June confirm continued austerity.

The Chancellor produced what amounted to three mini-Budgets in his Autumn Statement last December. Many tax bands and social security rates were set for the years up to and including 2015/16. For example, we know the higher rate threshold will rise 1% a year and that the inheritance tax nil rate band will remain stuck at its 2009/10 level of £325,000.

The 2015/16 spending review shows how Mr Osborne will use the money he plans to raise by sub-inflation increases to benefits and tax bands. The review only covers one year instead of the usual three or four because the coalition government’s term ends in May 2015 – an inconvenient month after the current spending review period ends. In line with the press predictions, the review incorporated £11.5bn of spending reductions. However, as the Institute for Fiscal Studies (IFS) notes in its commentary on the spending review, “cuts of a similar magnitude are pencilled in for the two years from April 2016 as well.”

The IFS also observes that the austerity programme split between spending cuts and tax increases is currently 85:15 against the government’s planned 80:20 division. Bringing the mix back into line would mean a £6 bn tax increase in the next parliament according to the IFS’s number crunchers. The IFS remarks that “Coincidentally this is pretty close to the average tax increase seen in post-election budgets in recent decades.” You have been warned.

Busy going nowhere

The first six months of 2013 were a roller coaster ride for investors.

Source: Digitallook.com

“The value of investments can go down as well as up”. That familiar warning has been all too true over the first half of 2013, particularly in terms of the UK stock market. If you had hibernated for the first six months of the year – it has mostly been winter, after all – you would have woken to find the FTSE 100 318 points (5.4%) above the level at which it started the year. Not bad, especially when you add in the six months of dividends, worth about 2%.

What you would have missed during your slumbers was a 16% rise in the market to 22 May followed by a 9% decline over the remainder of the period. It was a similar story in most other major stock markets, with Japan experiencing an even greater roller coaster ride: the Nikkei 225 started the year at 10,395.2 and climbed to 15,627.3 before eventually ending June at 13,677.3.

The bifurcation has largely been attributed to one man – Ben Bernanke, chairman of the US Federal Reserve – and his pronouncements about the future ‘tapering’ of quantitative easing (QE – electronic ‘money printing’). Nobody in the markets had been expecting that QE would carry on forever creating $85bn a month to buy bonds, but to borrow a US banker’s memorable phrase from shortly before the credit crisis hit, “As long as the music is playing, you’ve got to get up and dance”.

What will happen when Mr Bernanke starts to turn down the music’s volume was the big worry for investors – hence the rush to the exits in recent weeks. However, in the panic, little attention was paid to the provisos which the Fed Chairman had placed on the taper process. It will be subject to satisfactory US economic performance, so if unemployment does not fall as expected or inflation drops further, the tapering could be undone. By the end of June, that conditionality had started to sink in, helping the markets to recover their composure and some of the losses.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

National Savings & Investments cut rates

The best short term rates are disappearing.

National Savings & Investments (NS&I) have announced cuts in interest rates to three of its variable rate products to take effect from 12 September, as shown in the table below.

NS&I Product |

Today’s Rate |

Rate from 12/9 |

Change |

Direct ISA |

2.25% |

1.75% |

-0.5% |

Income Bonds |

1.75% |

1.25% |

-0.5% |

Direct Saver |

1.50% |

1.10% |

-0.4% |

The cuts are no real surprise, not least because the government set NS&I a net fund-raising target for 2013/14 of nil (give or take £2bn). NS&I’s current variable rates leave it at or near the top of the short term savings league table, which means it is liable to attract substantial inflows. The Financial Services Compensation Scheme deposit protection ceiling of £85,000 is irrelevant to NS&I investors, thanks to a Treasury guarantee. As a result the only effective restriction on individual investment is NS&I’s own limits - £2m for Direct Saver and £1m for Income Bonds.

Shortly after NS&I revealed its deferred interest rate cuts, another NS – ONS (the Office for National Statistics) – published May inflation data showing year on year price increases of 2.7% (Consumer Prices Index) and 3.1% (Retail Prices Index). The news was a reminder how far deposit rates have dropped below inflation, even before tax is taken into account. If you are a higher rate taxpayer, you now need a 4.5% gross interest rate to match CPI inflation. However, the best rates available – fixed for a five year term – are under 3%.

Premium Bond Footnote NS&I did not change the prize money rate for premium bonds, which remains at 1.5%. As premium bond prizes are tax-free, in theory that is equivalent 2.5% gross if you are a higher rate taxpayer. The trouble is that the chances of a win each month are 24,000:1 and over 96% of the prizes are just £25.

When I’m 64+…

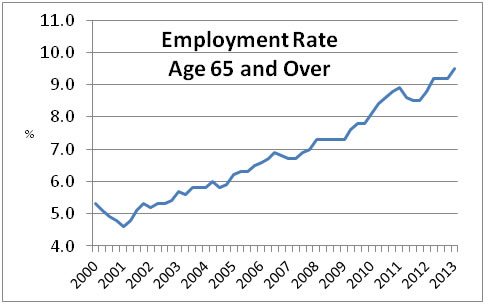

The number of people aged over 65 in work has reached a new record.

There are now over one million people in work aged 65 or over according to the latest statistics from the ONS. That represents nearly one in ten of the 65 and older population – more than double the proportion at the start of 2001. As the graph shows, there has been a steadily rising trend, seemingly immune to the vagaries of the UK economy since the turn of the millennium.

ONS attributes the breaching of the one million threshold to more people staying on in work and also more people of this age group in the population (the first tranche of the post-war baby boomers is now 65+). The abolition of 65 as a statutory retirement age, which took full effect in October 2011, has probably also helped boost the in-work numbers.

ONS does not define the proportion of the 65+ workers whose financial situation means that they have no alternative to continued employment, even if it is generally part time. The generation now retiring is often thought of as the lucky ones because their working life coincided with the era of final salary pensions, but that is something of an oversimplification. Final salary schemes were not the province of small employers, nor were those in self-employment able to benefit.

If the idea of working beyond 65 does not appeal to you, make sure your retirement provision is adequate. Otherwise, B&Q may beckon…

No island escape for tax avoiders

The Channel Islands and the Isle of Man have long resisted an automatic exchange of information with the UK tax authorities.

However, when the US set in train its latest tax avoidance measures, Jersey, Guernsey and the Isle of Man found themselves in a difficult position. As Crown Dependencies, the islands needed the consent of the UK Government to reach an agreement with Uncle Sam.

The Treasury took advantage of this, effectively insisting that if the islands were to make automatic disclosures to the US under the Foreign Account Tax Compliance Act (FATCA), then the UK authorities were equally entitled to a similar flow of information. The islands could not afford to ignore FATCA and say goodbye to US business, so they all agreed to automatic disclosure with the UK.

As a result, HMRC has launched ‘disclosure facilities’ covering Guernsey, Jersey and the Isle of Man to “provide an opportunity for eligible customers with assets or investments held in British Crown dependencies…to bring their UK tax affairs up to date.”

An agreement with the Cayman Islands and British Virgin Islands is due shortly.