Overhauling pensions – the big story

The Chancellor delivered a major reform on the pension front, one that was completely unexpected and potentially game changing – witness the dramatic fall in some life company share prices.

The main points of a two stage process are:

Initial phase from 27 March 2014

Income drawdown For income drawdown years starting on or after 27 March 2014, the maximum capped withdrawal increases from 120% to 150% of the HMRC/GAD rate (broadly equivalent to the market annuity rate). The minimum income requirement (broadly state, annuity or occupational pension) for flexible drawdown falls from £20,000 to £12,000 a year, subject to scheme rules. With the single basic state pension worth £113.10 a week in 2014/15, that means only a little more than £6,100 of other secure pension will be needed to allow unrestricted withdrawals.

Small pension pots The rules which allow small pension pots to be commuted for a lump sum are relaxed, making it easier to turn them into cash. The new overall limit for turning all pension wealth into cash increases from £18,000 to £30,000.

Second phase from 2015/16 onwards

Flexible income drawdown In effect, the minimum income requirement will disappear, so that from age 55 if you have personal pension or other defined contribution pension (not a final salary scheme), then you can take whatever withdrawals you wish, whenever you want – subject to having the necessary funds available. The Chancellor presented this as an end to the requirement to buy annuities, although in practice annuities are still likely to have a role to play if you want to guarantee income for life.

Guidance guarantee The government will require your pension provider to offer “free and impartial face-to-face guidance” when you retire, if you are in a pension scheme other than a final salary scheme. The practicalities of this await clarification, but one aspect is already clear: it will be ‘guidance’ on offer, not advice. So you will still have to make your own decision or seek professional advice.

There are other changes with a longer term timescale which are subject to consultation, e.g. on the minimum age at which you can take benefits. If you are close to retirement, it is vital to take advice before making any decisions: the retirement world has been changed by Mr Osborne and your plans will almost certainly need a review.

Employment allowance – up to £2,000 off your class 1 nic

From 6 April 2014, employers can claim the Employment Allowance and reduce their employer Class 1 national insurance contributions (NICs).

The Employment Allowance is available from 6 April 2014 and those who are eligible can reduce their employer Class 1 NICS by up to £2,000 each tax year. You can claim the Employment Allowance if you are a business or a charity (including community amateur sports clubs) that pays employer Class 1 NICS on your employees’ or directors’ earnings.

If the company belongs to a group of companies or the charity is part of a charities structure, only one company or charity can claim the allowance. You can decide for yourself which company or charity will claim the allowance.

The £2,000 Employment Allowance can only be claimed against one PAYE scheme – even if your business runs multiple schemes and not all businesses can claim it. The allowance can be claimed by either using your own 2014 to 2015 payroll software, or HM Revenue & Customs’ (HMRC) Basic PAYE Tools for 2014 to 2015. When making your claim, you must reduce your employer Class 1 NICs payment by an amount of Employment Allowance equal to your employer Class 1 NICs due, but not more than £2,000 per year. For example if your employer Class 1 NICs are £1,200 each month, in April your Employment Allowance used will be £1,200 and in May £800, as the maximum is capped at £2,000.

HMRC will automatically carry your claim forward each tax year so it is important to check that your circumstances haven’t changed at the beginning of each year. If you are exempt from filing, or unable to file online, you can claim the Employment Allowance, at the beginning of the tax year, using the paper Employer Payment Summary.

Personal Tax – Higher rate taxpayer numbers on the rise

The days when Budgets revealed tax allowances and bands for the coming tax year have long since passed.

These days the Autumn Statement normally covers such matters, leaving the Budget for next-tax-year-but-one announcements. Thus the £10,000 personal allowance for 2014/15 was already a fact and the Chancellor’s announcement of a £10,500 allowance for 2015/16 was so widely leaked as to be no real surprise. The starting points for higher rate tax in both years were already known: £41,865 in 2014/15 and £42,285 in 2015/16.

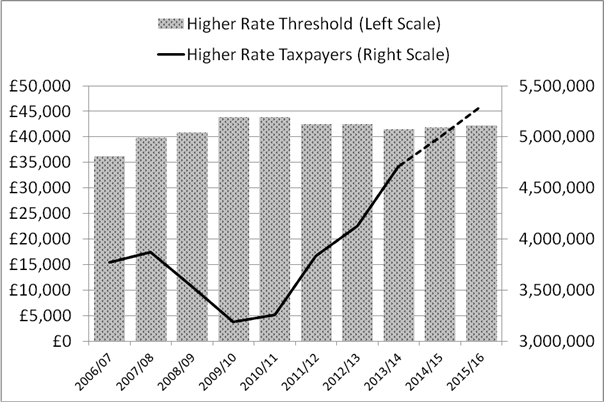

The sub-inflation increases in the higher rate threshold will mean that by 2015/16 there will be 5.3 million higher rate taxpayers, a 2 million increase over 2010/11 according to the Institute for Fiscal Studies (IFS).

While shrinking the basic rate band (by £145 for 2014/15 and £80 for 2015/16), Mr Osborne did the opposite with the starting rate band, which only applies to savings income:

- The band rises by £90 to £2,880 in 2014/15.

- In 2015/16 it will undergo a radical change, with the rate cut from 10% to 0% and the size of the band nearly doubled to £5,000.

The 2015/16 revisions is a mix of politics, smoke and mirrors. Ed Balls, the Shadow Chancellor, plans to reinstate a 10% starting band for all income, something his earlier boss (Gordon Brown) abolished, so Mr Osborne took delight in removing the 10% rate from the tax scales before the election. Mr Osborne’s revamp will potentially benefit only 1.5 million taxpayers, with half gaining no more than £50 a year. How many actually benefit will depend upon the numbers that bother to reclaim tax deducted at source.

Welcoming the New ISA

Last year it was reported that the Treasury had asked ISA providers about the practicalities of capping total investments at £100,000. Anyone expecting the worst in the Budget was pleasantly surprised.

Initially the ISA limit rises to £11,880 for 2014/15 (£5,940 for cash element), but more radical changes begin on 1 July 2014:

- All ISAs will automatically become New ISAs (NISAs).

- The investment limit for 2014/15 will rise to £15,000, i.e. an increase over the initial limit of £3,120.

- The distinction between cash and stocks & shares accounts will disappear, so the full £15,000 could be placed in a cash NISA.

- Transfers will be allowed from stocks & shares NISAs to cash NISAs – the opposite move for ISAs has been possible for some time, but only as a one-way trip. The reversibility means that the current 20% flat rate tax charge on cash interest in stocks & share accounts will disappear.

- The restriction on stocks & share accounts investing in fixed interest securities with less than five years to maturity will also be scrapped.

In addition, there will be consultation on including in the list of eligible investments peer-to-peer lending and debt raised by crowdfunding platforms.

New tax statements extended to an extra four million people

From October 2014, around 24 million people will receive a personal tax statement from HM Revenue & Customs (HMRC).

The statement will set out the amount of tax they paid in the previous year and how it contributed to public expenditure, the Chancellor of the Exchequer, George Osborne, announced on 3 April. This move is part of the Government’s wider drive to make the tax system simple, easier to understand and more transparent.

“These tax statements represent a huge boost for tax transparency, showing people very clearly how much tax they pay and giving them a better understanding of where their money is spent,” the Chancellor said.

Mr Osborne announced that from October 2014, around 24 million people will receive the personal tax statement – 4 million more people than announced at Budget 2012. The additional people are PAYE taxpayers who have had recent contact from HMRC setting out their tax calculation for an earlier year.

They include 8 million taxpayers who complete self-assessment returns and receive their tax statement online, 16 million PAYE taxpayers who received a tax coding notice from HMRC for 2013 to 2014, as well as four million PAYE taxpayers with complex or changing circumstances who have had recent contact from HMRC setting out their tax calculation for an earlier tax year.