UK and Cayman islands sign agreement

The UK and the Cayman Islands have signed a tax information sharing agreement.

The UK has signed an automatic tax information sharing agreement with the Cayman Islands, HM Treasury announced on 5 November. The Cayman Islands are the first such Territory to formalise their agreement with the UK. Financial information on UK taxpayers with accounts in the Cayman Islands will now be automatically provided to HM Revenue and Customs (HMRC) to ensure that the correct amount of tax is being paid.

Chancellor of the Exchequer, George Osborne, said that alongside the significant investment that the Government has made in anti-avoidance and evasion work, this agreement will help HMRC to clamp down further on those individuals who seek to hide their assets offshore. This announcement follows the agreements signed between the UK and the Crown Dependencies of the Isle of Man, Jersey and Guernsey in October.

The Cayman Islands have also concurred to be part of the G5 multi-lateral information sharing pilot, agreed between the UK, France, Germany, Italy and Spain, which will see the Cayman Islands automatically exchanging information about bank accounts held by taxpayers from their jurisdictions. A total of 31 jurisdictions have now joined the initiative.

Chancellor of the Exchequer, George Osborne, made the following statement:

“The UK has led the way in creating a new global standard for tax transparency and automatic tax information sharing. This was at the heart of our G8 agenda this year and today’s agreement builds on the progress we have already made.

We welcome this signing with the Cayman Islands, the first Overseas Territory to sign this type of agreement with the UK. This demonstrates our shared commitment to tackling tax evasion.

Alongside the significant investment that the government has made in HMRC’s anti-avoidance and evasion work, these agreements will help them clamp down further on those individuals who seek to hide their assets offshore.

Our message is very clear: it is only fair that people pay the tax they owe. If you are trying to evade tax, we are coming after you”.

HMRC CRACK DOWN ON EXPLOITATION OF INTERNS

HMRC to ensure that companies pay their interns the minimum wage

HM Revenue and Customs (HMRC), which enforces the minimum wage, will be contacting businesses and checking whether the companies who have recently advertised for interns are paying the correct minimum wage. It is expected that around 200 employers will be contacted by HMRC. The move, which was announced on 11 November, is part of an initiative to give interns more help and information to ensure they’re paid for the work they do.

The Department for Business, Innovation and Skills will be cracking down on unfair practices from employers, and has released guidance for young people as a protective measurement. Employment Relations Minister, Jo Swinson, said: “Leaving education and getting a job for the first time can be daunting for any young person. Internships can provide an important first step and are often a valuable way of helping young people start work. They should be open to everyone in a fair and transparent way”.

“To do this, we have to give young people the information and support they need so they are less likely to be exploited. Not paying the national minimum wage is illegal and if an employer breaks the law, the government will take tough action. Already this year HMRC has issued penalties to 466 employers. Anyone considered a worker under the law should be paid at least the minimum wage, whether they are an intern, or someone on work experience”.

September inflation data

The latest inflation numbers are not as important as they once would have been.

September’s retail prices index (RPI) figures, which emerged last month, would once have been the drivers for a variety of tax and benefit increases from next April. However, that is no longer the case. The Chancellor first moved over to the consumer prices index for most direct taxes and benefits, but has since chosen his own rate of increase. Thus:

- In April 2014 the personal allowance will increase by 5.9% to £10,000, well above the September inflation rate of 3.2% (RPI) or 2.7% (CPI)

- The quid pro quo for the boost to the personal allowance is that the starting point for higher rate tax (ie personal allowance + basic rate band) will rise by just 1% (£415) to £41,865, which means that the basic rate band will shrink by £145. The same 1% increase to the higher rate tax threshold will occur in 2015/16.

- The capital gains tax annual exempt amount will also rise by a mere 1% - making it £11,000 in 2014/15. A £100 rise will occur again in 2015/16.

- There will nether be a change in the £150,000 starting point for additional rate tax, nor the £100,000 threshold at which the personal allowance tapering begins.

- Most in-work social security benefits, including Child Benefit, will rise by 1%.

- State pensions will rise by 2.7%. The basic state pension is subject to the ‘triple lock’, which this year that means an increase in line with CPI, which is the normal increase basis for all other state pensions.

The process of keeping many tax and benefit increases at below the inflation rate is a well-used Treasury tool for extracting more revenue from the public. At present it is not working quite as the Chancellor might hope because earnings growth is so low. The latest figures show an annual increase of just 0.7%.

Is 8% enough?

The final level of contributions under pension auto-enrolment is probably too low, according to one leading pensions organisation.

Last month marked the first anniversary of pension auto-enrolment, which is gradually being rolled out across the UK employed workforce, starting with the largest employers. So far take up has been better than many had predicted, with less than 1 in 10 employees opting out after auto-enrolment, according to the DWP.

The low opt out rate probably reflects the efforts which have put into the process by the major employers – like the supermarkets and banks. However, another factor could well be the current level of contributions: the minimum total contribution (employer and employee) in 2013/14 is 2% of band earnings (annual earnings between £5,668 and £41,450). If the employer pays just their required 1%, the most an employee’s outlay will be is £23.85 a month after basic rate tax relief.

Total contributions are set to rise to 5% (2% employer minimum) in October 2017 and 8% (3% employer minimum) a year later. Thus, if an employer limits contributions to the legal floor, in five years’ time their employees’ contributions would be five times the current level.

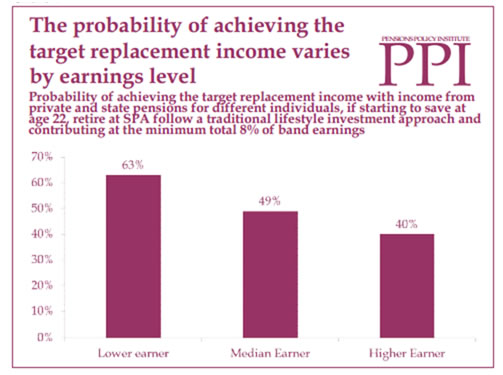

Whether that will prompt a rise in opt out rates remains to be seen, but there are already voices saying the 8% total is not enough. The latest is the Pensions Policy Institute (PPI), which has used a statistical model developed by King’s College, London to look at the chances that the combination of auto-enrolment and the forthcoming single tier state pension will provide an adequate retirement income. Its main conclusion was that for a median earner, a contribution of 8% of band earnings throughout their working life will give them “less than fifty-fifty chance of achieving an adequate retirement income.”

The PPI’s research echoed the findings of DWP work in the same area of retirement income adequacy. In particular the PPI said that higher earners need to contribute more than median and low earners because the proportion of their final earnings presented by the single-tier pension is that much less. Their calculations are shown in the chart below.

IsA Freeze

The Treasury has been talking about an ISA cap.

The Treasury has been consulting with financial services companies about the possibility of a cap on the amount that can be held in ISAs according to reports in one national newspaper. A figure of £100,000 was allegedly suggested by one Treasury official. There have been no denials from the Treasury, which has said it was just listening, not putting forward any firm proposals.

The idea of putting a cap on ISA investment is not new. When ISAs were first proposed as a replacement for PEPs (Personal Equity Plans) back in the late 1990s, there were suggestions that a combined ISA/PEP ceiling of £50,000 should be introduced. The outcry which followed prompted the Chancellor of the time, Gordon Brown, to back down. The return of a cap consideration now is unsurprising, given the value of ISA funds had reached £443bn by the start of this tax year and the annual income tax cost to the Exchequer is put at £1.75bn. That cost could increase significantly when interest rates start to rise.

With pension allowances being cut again from next April, ISAs could be the next savings vehicle to which the Treasury takes the axe. There are some ISA millionaires, reportedly a concern for the Treasury, but the numbers are almost certainly very small: if you had invested the maximum in PEPs and ISA from January 1987, your total contributions would amount to £212,320 and you would have needed an annual return of nearly 12% after all charges to hit a seven figure value now. The £100,000 target is clearly much easier and one estimate is that it would catch around 2% of all ISA investors.

Will it happen? If anything, an ISA cap looks more like an immediate post-election move rather than something that will happen soon. Nevertheless, as Mr Osborne has announced that he will be presenting the Autumn Statement on December 4, you might want to think about making this year’s ISA contribution in November rather than waiting for next March.