VAT fraud couple sentenced

A South Yorkshire couple who pleaded guilty to £600,000 in VAT fraud were sentenced to prison terms on 24 September.

Craig and Tracy Taylor of Wortley ran a construction business of a number of years’ standing prior to their arrest. Problems began for the couple when their business began to fail and rather than go bust, they began to fund a lavish lifestyle with the proceeds of an illegal VAT repayments fraud.

Over a two-year period the pair reclaimed VAT on work related to the construction of new-build homes, despite the fact that their business collapsed in the summer of 2009. In a bid to siphon the illegal profit out of the firm, they would pay themselves tens of thousands of pounds each week as part of a salary, with the money then moved around a network of accounts in a bid to make it seem legitimate.

It was only when HM Revenue & Customs officers began to look into their financial affairs that a VAT fraud totalling £600,000 was uncovered. Mr Taylor had even submitted another claim for £79,000 in 2011, two years after the company ceased trading, though this was ultimately dropped.

Assistant Director for Criminal Investigation, Peter Hollier, said: “The pair used the money to fund a two-year spending spree, spending thousands on luxury items most hard working families can’t afford.

"Once HMRC began to investigate the couples’ financial affairs there was nowhere to hide, and what the Taylors thought was a clever way of moving and hiding money soon unravelled.” The pair pled guilty to charges of money laundering and VAT fraud at Sheffield Crown Court.

UK tax competitiveness improved, says KPMG

The UK’s tax competitiveness has improved markedly over the past two years, a new study conducted by KPMG International has revealed. According to the firm's new publication “Competitive Alternatives 2012, Special Report: Focus on Tax”, which examines the impact of all business taxes in 14 of the world's biggest economies, the UK has seen the biggest boost over the last 24 months.

The KPMG research took into account capital taxes, sales taxes, corporate income taxes, statutory labour costs and property taxes to calculate a ‘total tax cost’ for each country. This was then compared with other countries and cities using a Total Tax Index for each location. The TTI represents a measure of the total taxes paid by firms in particular locations and are presented as a percentage of total taxes paid. By this measure, the lower the TTI, the more attractive a region is from a business tax viewpoint.

According to the study, the UK fared well, with a 15 percentage point rise in its score since the last reading in 2010, leaving it placed as the sixth most attractive – ahead of the US and all other European nations in the research. Chris Morgan, Head of Tax Policy at KPMG in the UK, said: “The significant change for the better is partly due to reductions in the corporate income tax rate here in the UK. It is also due to lower industrial property values in 2012 which have resulted in a reduced burden for other corporate taxes.”

Direct sellers invited to settle tax.

Direct sellers have been invited to settle their tax affairs with HMRC as part of a new campaign. Often operating under job titles such as consultants, representatives, distributors and agents, these direct sellers work without the need for business premises selling to customers in their home, at parties or door to door.

At present, they earn money through commission on any sales they make on the road. As such, they are generally considered to be self-employed, which means they are responsible for informing HMRC of how much they earn and for calculating and paying their tax.

Under the terms of the new agreement, direct sellers will be invited to pay the tax they owe and benefit from lower penalties, rather than waiting and facing heftier charges later. Marian Wilson, head of HMRC Campaigns, said: “If you are involved in direct selling and have not told HMRC about all of your income, you may not be paying the right amount of tax. The Direct Selling campaign is an opportunity for you to bring your tax affairs up to date, on the best possible terms.”

RPI to be revised?

The statisticians are considering a revamp of the retail prices index (RPI).

In recent years the consumer prices index (CPI) has gained in importance over the longer-established RPI. Most state benefits are now linked to the CPI, as are public sector pensions and, since April 2012, all direct taxes (unless there is a specific exemption). However, the RPI remains the benchmark that is most widely quoted and used outside government circles. Significantly, the RPI includes owner-occupied housing costs, which at present are largely excluded from the CPI.

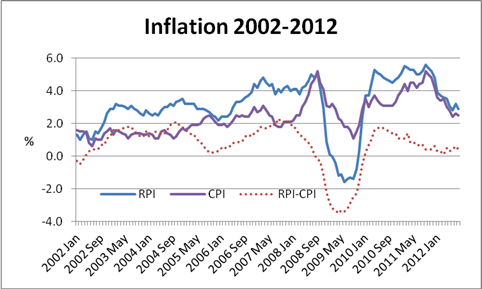

The greater emphasis being given to the CPI has encouraged comparison between the two indices. As the graph shows, the two have diverged considerably at times over the last ten years.

The RPI-CPI ‘wedge’ in the latest (August 2012) inflation figures is only 0.4%, but the average over the last ten years is 0.7%, and for much of 2007 the gap was close to 2%.

There are arcane mathematical reasons why components of the two indices can differ, even when they are measuring the same products. Last month the Office for National Statistics began a consultation process that could see the calculation basis for the RPI (not what it measures, but how it measures) revised next March. The predictable aim would be to align the RPI more closely with the CPI.

Any such change to the RPI raises some complex issues – for example, how are the holders of index-linked savings certificates or the £280 billion worth of index-linked government bonds to be treated?

State pension reform reformed?

State pension reform is reported to be worrying the Prime Minister.

At the beginning of this month, one of the most private sector significant pension reforms started with the roll out of the first stage of auto-enrolment. By the end of the year over 600,000 people will have been automatically enrolled in a workplace pension scheme, according to the Department for Work and Pensions (DWP). By March 2015 the DWP estimates that the number will have risen to 4.3 million.

One potential problem identified early on in the development of auto-enrolment was that for some low paid people, the private pension they earned would merely replace the Pension Credit they would otherwise have received from the state. Their (and their employer’s) contributions would therefore produce no extra retirement income.

After much agonising, it appeared that the Government had resolved the issue by announcing a wholesale reform of state pensions. The idea behind this was to replace both the Basic State Pension (BSP) and the State Second Pension (S2P) with a single tier pension, pitched at a level – about £143 a week – that allowed Pension Credit to be scrapped for new pensioners.

The logic was clear enough, but the DWP acknowledged there would be plenty of transitional issues. Handling these is particularly difficult because of the Treasury’s insistence that any reform has to be self-funding. Press reports now suggest that David Cameron has got cold feet about the DWP’s radical plans. While the reform would create winners – those whose state pension entitlement increased to £140 a week – there would also be losers, like some of those who reached their state pension age the day before the uplifted benefit came into being.

We must now wait for a White Paper, due later this year, to see how the DWP deals with the Prime Minister’s concerns. Meanwhile, the saga has provided another reminder of the folly of relying upon the state for your retirement income.

HMRC, IHT and property valuations

HMRC are watching probate property valuations.

Tony Blair may have labelled himself a ‘naive, foolish, irresponsible nincompoop’ for introducing the Freedom of Information (FOI) Act, but it does provide some useful insights into the way government works that would otherwise have remained under wraps. The latest example to raise a few eyebrows was an FOI request from UHY Hacker Young, the accountants. The firm asked HMRC how much extra inheritance tax (IHT) had been raised as a result of challenging and revising property valuations submitted in probate applications.

The answer for 2010/11 was £88 million, up from £70 million the previous year. The FOI request revealed that the tax average uplift was over £27,000, implying an average valuation uplift of nearly £70,000 across around 3,250 estates. Although no details were obtained, it is likely that in many cases HMRC also levied penalties, which can now be up to 100% of the extra tax due.

Under pressure to raise as much revenue as possible, HMRC has become increasingly adept at using a wide range of information sources to verify tax return data. The IHT valuation uplift is a good example. If you have not reviewed your estate planning for a while, it could be worth a look to make sure it takes account of all your current wealth.

The Financial Services Authority does not regulate tax advice.